Guidelines for the Stalking Horse Buyer in a §363 Bankruptcy Sale

The recent bankruptcy in September 2025 of both First Brands, a large auto parts company with liabilities as high as $10 billion to $50 billion, and Tricolor Holdings, a subprime auto lender listing between $1 billion and $10 billion liabilities, has highlighted the risks of the $2 trillion private credit market. Knowing the guidelines for a stalking horse buyer can be a definite advantage for buyers in a precarious 2025 economy.

A “stalking horse” has significant advantages in a bankruptcy sale process. Buying assets through Section §363 of Chapter 11 of the bankruptcy code sets out procedures for the sale of tangible and intangible assets. A sale of assets pursuant to §363 can provide purchasers with a variety of benefits, as well as a number of challenges, particularly for the unfamiliar.

Assets acquired in a §363 sale are delivered free and clear of all liens, and are not subject to fraudulent transfer claims and/or contingent liabilities (e.g., successor liability and warranty claims). Moreover, upon court confirmation of a sale, the purchaser can be certain about the enforceability of the transaction documents, relief from the need to obtain consent to the assignment of certain contracts, a shortened Hart-Scott-Rodino Antitrust Act waiting period, and exemptions from state laws regarding bulk sales and stockholder approval.

The rules also tend to inject time limits into the sale process. And, of course, final court approval can depend on resolution of creditor objections.

Stalking Horse Bidder

The initial bidder with whom the debtor negotiates a purchase agreement is called the “stalking horse,” an old hunting euphemism referring to either a real horse or disguise, behind which a hunter would conceal himself to get closer to his prey.

Fees that the stalking horse incurs for legal and financial advisers, due diligence are generally reimbursed if the stalking horse is outbid. To qualify for reimbursement, the stalking horse should insist that its expenses are included as administrative expenses, the high priority creditor claim in bankruptcy.

The break-up fee is incremental compensation to induce the initial bidder to establish a “floor” for other potential bidders in an auction. However, approval requires the court to find that the break-up fee is “necessary to preserve the value of the estate.

The stalking horse bidder also will want to establish steep bidding increments to discourage competing bids and will want “matching rights” to minimize its costs to stay in the auction.

A topping fee is a percentage of the difference between the winning bid and the stalking horse bid that must be paid to the stalking horse bidder. This differentiates it from a breakup fee, which is a set amount.

The stalking horse has the opportunity to negotiate an asset purchase agreement, in a manner that will not be easily adaptable by other bidders. The stalking horse might select which assets it wishes to acquire and/or which obligations it wants to assume.

Bed, Bath & Beyond

In the case of Bed Bath & Beyond bankruptcy case, Overstock.com was a stalking horse and, since there were no other bids, won the action. Overstock.com's bid proved to be enough. Overstock.com bought the brand out of business and relaunched its website.

Overstock.com Wins $21.5 Million Bid for Bed Bath & Beyond’s Assets

However it’s possible, particularly before the closing of an auction, for courts to consider, among other things, belated and otherwise non-compliant higher value offers. For example:

Why many different First Brands LLCs filed for bankruptcy separately

First Brands' use of separate bankruptcy filings was part of its highly complex and opaque corporate structure. First Brands was a holding company with 112 separate subsidiaries, each operating as a distinct LLC. This structure allowed it to keep various business units and financial arrangements legally separate. Below are the operating companies and case numbers for the First Brand bankruptcy:

Operating Company - Case No. (S.D. Texas)

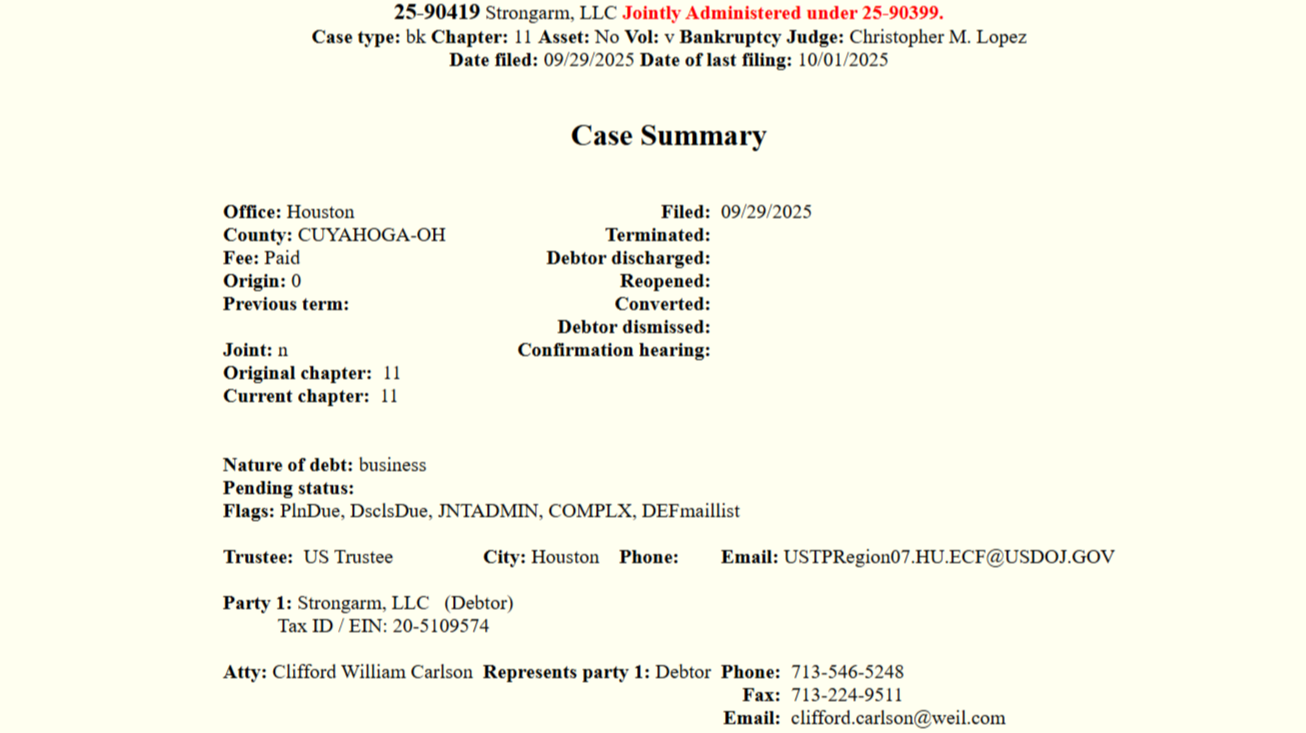

StrongArm, LLC 25-90419

FRAM Group Operations LLC 25-90403

FRAM Group IP LLC 25-90404

Autolite Operations LLC 25-90402

Champion Laboratories, Inc. 25-90445

Trico Technologies Corporation 25-90396

Pylon Manufacturing Corp. 25-90461

Hopkins Manufacturing Corporation 25-90412

Carrand Companies, Inc. 25-90413

Carter Fuel Systems, LLC 25-90422

Airtex Industries, LLC 25-90434

Walbro LLC 25-90430

Jasper Rubber Products, Inc. 25-90406

ASC Industries, Inc. 25-90408

Specialty Pumps Group, Inc. 25-90407

Horizon Global Corporation 25-90414

Horizon Global Americas Inc. 25-90416

International Brake Industries, Inc. 25-90451

TAE Brakes, LLC 25-90446

Transportation Aftermarket Enterprise, LLC 25-90447

Qualitor, Inc. 25-90443

Cardone Industries, Inc. 25-90493

SDC TX, LLC 25-90494

CWD Holding, LLC 25-90462

Premier Marketing Group, LLC 25-90420

AVM Export, Inc. 25-90421

Universal Auto Filter LLC 25-90449